As the business world goes increasingly digital, the need for robust identity verification measures has never been more critical. Many companies today operate in remote and digital environments, which can open doors to cybersecurity threats such as identity fraud. Ensuring the authenticity of employees, partners, and customers is paramount. A comprehensive understanding of current trends in identity verification can help businesses safeguard their data, finances, and reputations.

Understanding Identity Verification

Identity verification is the process of confirming that an individual is who they claim to be. This process is essential for establishing trust and mitigating risks in various business contexts, including employee onboarding, customer authentication, and partner relationships.

Digital identity verification is a necessity in today’s business landscape. According to the Financial Crimes Enforcement Network (FinCEN), companies face “significant identity-related exploitations through a large variety of schemes.” The most recent FinCEN report found $212 billion in suspicious activity in 2021, highlighting the scale of the problem.

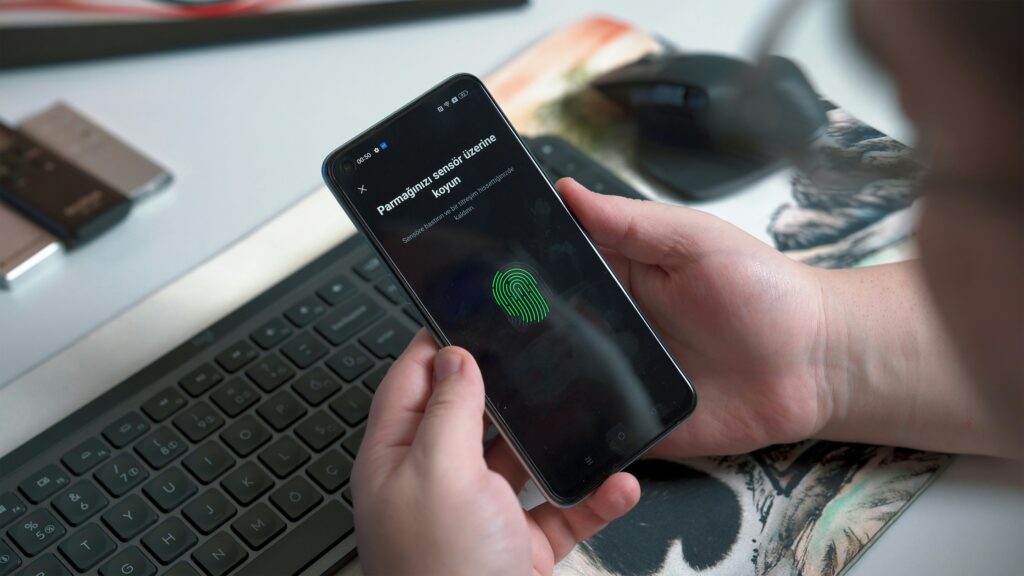

To combat this danger, companies can use several methods of identity verification, including document verification, biometrics (such as fingerprints or facial recognition), and knowledge-based verification (asking questions only the true individual would know). Each method has its strengths and weaknesses, and businesses must choose the most suitable approach based on their specific needs and risk profiles.

The Challenges of Identity Verification

Despite its importance, identity verification poses several challenges for businesses. One common challenge is the difficulty of verifying identities remotely, especially in a world where face-to-face interactions are limited. At the same time, businesses need to protect customer data and respect the customer experience by ensuring that their verification systems are both robust and efficient.

However, setting up a strong ID verification system is not something that companies can put off. The risks associated with inadequate or ineffective identity verification measures include identity theft and fraud. Businesses may face financial losses, damage to reputation, and legal consequences if they fail to adequately verify the identities of individuals they interact with.

A high-profile identity cloning scam in the U.K. made the news recently, with more than 750 fake firms registered with the UK government’s central business registry in the first six weeks of 2024. These criminals assumed the identities of famous chefs in order to take out business loans. The impact on the victims of the fraud and the restaurant industry, in general, was significant, indicating the importance of verifying identities in business.

Implementing Effective Identity Verification Measures

According to Juniper Research, the number of digital identity verification checks is expected to surpass 70 billion in 2024. Report author Michael Greenwood commented, “Verification systems that can perform multiple checks in one step offer a significantly stronger user experience than legacy systems, and will become commonplace over the next few years.”

Implementing effective identity verification measures requires careful planning and consideration. Business owners should first assess their specific needs and risk factors to determine the most suitable identity verification solution for their organization. This may involve investing in identity verification software or partnering with third-party providers.

Best practices for implementation include integrating identity verification seamlessly into existing workflows and systems, balancing security with user experience, and regularly reviewing and updating verification processes to adapt to changing threats and regulations.

The future of identity verification will be shaped by emerging technologies and evolving regulatory landscapes. Technologies such as blockchain, artificial intelligence (AI), and decentralized identity have the potential to revolutionize identity verification processes, offering enhanced security, privacy, and user control. Business owners must stay informed about these developments and be prepared to adapt their identity verification strategies accordingly.

Conclusion

Identity verification is a critical aspect of business operations in today’s digital world. As evidenced by recent identity cloning scams and the staggering amount of suspicious activity reported by FinCEN, the need for vigilance in identity verification has never been more apparent. By understanding the importance of identity verification, the challenges and risks it entails, and the strategies for implementing effective measures, business owners can protect their organizations from fraud, build trust with stakeholders, and ensure compliance with regulations. As technology continues to evolve and regulations change, staying proactive and adaptable is key to maintaining robust identity verification practices and safeguarding business interests.

This article was originally published in Certainty News.